Key Points for Investment and Co-Creation by the Founder of Japan's Only VC Specializing in Food Tech

~Understanding Entrepreneurs is the Key to Success in Open Innovation

vol.2 Why are major business companies investing in startups these days?

0)Table of contents

・The first Insights from my experience with VC, startups, entrepreneurship and CVC (last time)

・The second Why are major business companies investing in startups these days?(this time)

・The third (Planned) Points of startup investment practice

・The fourth (Planned) Recommendation of hybrid investment

・The fifth (Planned) Co-creation between major business companies and startups

1)The end of self-sufficiency?

Traditionally, Japanese companies (particularly major companies) have carried out the value chain of research and development, manufacturing, and sales internally or within their own group (including affiliated business partners) (in-house principle, closed innovation). The in-house approach may have had advantages in terms of efficiency in mass production and transaction costs (including research, development, and communication costs related to new transactions).However, in recent years, with the diversification and sophistication of customer needs, the dramatic development of the Internet, and intensifying global competition, business has come to require speed.

Have you always valued caution? In order to respond quickly, major Japanese companies are forced to utilize ideas, technology, knowledge, and human resources outside of their existing networks, and open innovation is attracting attention. However, even recently, I have heard people from major companies say, We are self-sufficient," and We will knock on a stone bridge to get it over, but we won’t cross it.”

2)Open innovation (co-creation)

To begin with, open innovation is “in business, a company utilizes (incorporates) external ideas and technology, and at the same time allows other companies to utilize its own unused ideas.” When considering open innovation, in addition to the options between major companies, startups should also be included as an option. Major companies have similar cultures that make it difficult to innovate, it takes time to make decisions and lacks the speed that was originally intended, and companies within the group are involved in similar businesses, making it difficult to make progress. There are many cases.Of course, there are also good examples of open innovation between major Japanese companies. Typical examples are Uniqlo x Toray’s Heat Tech and down jackets. I will not explain it here, but if you are interested, please look into the details.

Startups do not belong to any affiliated company and are often challenging new markets while utilizing new technology, and can be said to be at the forefront of co-creation considerations for major companies.

3)What startups have

A startup is a company that develops new business models and markets and provides new value to society. In addition, the characteristics of startups include being conscious of innovation and solving social issues, aiming for rapid growth, and considering an EXIT strategy (initial public offering = IPO, M&A = selling the company to a major company) from the time of company establishment. You can

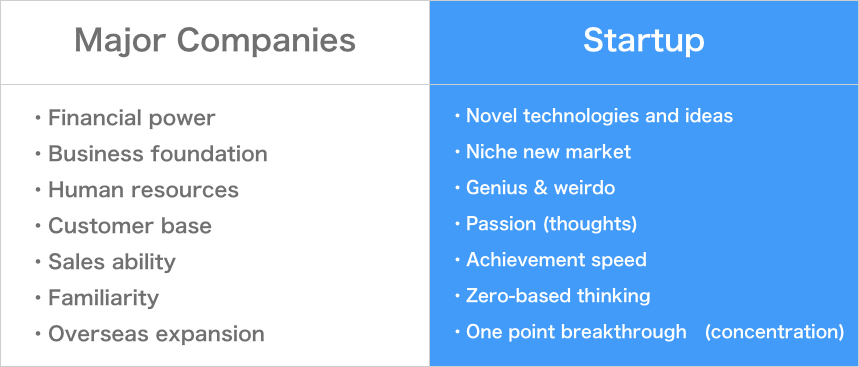

Let’s compare what major companies and startups have (or will have). Major companies seem to have it all, but if you look at this table, you’ll notice something.

・Even if major companies are aware of new markets, they may not be able to tackle them due to the “current market size.” “This is likely to come in a few years, but the market is too small for our company (a new niche market), so we can’t tackle it now.”

→Therefore, start making friends with the startups you are working on.

・There are very few geniuses or eccentrics (praise words) in major companies. Wrong? Even if they join the company, they end up leaving because they don’t feel comfortable. Or, they may have killed it by hitting the nail that sticks out.

→Growing startups often employ geniuses and eccentrics due to a chronic shortage of human resources due to rapid growth" andone-point breakthrough strategies.” Geniuses and eccentrics often have amazing skills and ideas. Co-creating with geniuses and eccentrics is highly likely to lead to open innovation.

・Startups make decisions, start work, and make changes very quickly. First, try it out, then continue to make improvements as you go. The approval regulations and governance systems of major companies may be a hindrance to speed, and it can also be said that startups are fast (zero-based thinking) because they do not have an existing business.

→In addition to learning technology and ideas, we also recommend learning about corporate culture from startups. There are cases in which owners of major companies with a long history (and former entrepreneurs) have utilized the mindset they had at the time of the company’s founding in “employee education” through co-creation with startup entrepreneurs.

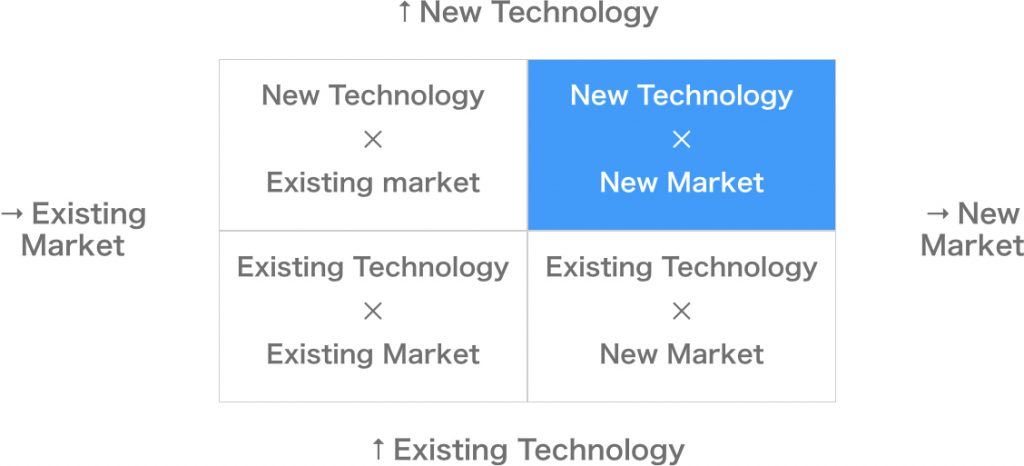

4)Technology × Market

Let’s look at a comparison between major companies and startups using a four-quadrant matrix of “technology x market.” I think that startups will find business opportunities and can easily demonstrate their strengths by taking on the challenge of “utilizing new technology and new markets” (blue area in the diagram). On the other hand, it may be difficult to compete with major companies in the other three areas.

If a major company aims to engage in open innovation (co-creation) with a startup, it may be a good idea to keep this matrix in mind. We always take this perspective into consideration when considering investments in agri-food tech startups.

5)Behavioral characteristics of startups (entrepreneurs)

The subtitle of this column is “Understanding entrepreneurs is the key to success in open innovation.” Let’s now look at the behavioral characteristics of entrepreneurs. This is just a subjective opinion based on the author’s experience, and is not based on any official research (lol).

・Start-up entrepreneurs value passion (thoughts). You could say that thoughts are the driving force.

・Startup entrepreneurs like to be impatient and work fast. I hate slow work and people who don’t respond (even if they say no).

・Start-up entrepreneurs start businesses because they want to innovate and solve social issues (in many cases).

・Start-up entrepreneurs prefer change to stability. I hate saying things like there's no precedent" orthings can’t be done the way they are.” The biggest risk is not taking risks. Risk is not something you take, but something you control (manage).

・Startup entrepreneurs value the future more than the past. I understand that the past creates the present and the present creates the future, but I am future-oriented and positive-minded.

・Startups (may be obvious) are short on funds and are trying hard to raise funds from venture capital and major corporate CVCs. The ability of the president (or other full-time director) to raise funds increases a startup’s corporate value and competitive advantage.

・Many startups are less well-known (compared to major companies) and often have weak sales capabilities. On the other hand, they have distinctive proprietary technologies and unique services (or business models).

6)Isn’t it okay to just trade?

I am often asked by major companies, “Why do we need to invest in startups? Isn’t co-creation and transactions enough?” In conclusion (lol), it’s not enough. Unlike large companies that are publicly traded, startups are privately held companies. Companies that are publicly traded disclose information such as executives’ backgrounds, financial statements, shareholder lists, and medium-term business plans on their websites. For unlisted companies that have not publicly traded their shares, their information is basically private. That’s why we are called a “private company” (lol).

Unfortunately, through co-creation and transactions, we have no access to extremely important information such as the biographies, financial statements, shareholder registers, and medium-term business plans of startup executives. Only by investing and becoming a shareholder will you be able to access extremely important information about unlisted companies (startups). Such information will lead to increasing the “accuracy and probability of realization” of co-creation with startups. For example, the following can be gleaned from this startup information:

・Do the focus areas of your future business plan include areas of interest to your company (major company)? What percentage of sales do you think it will account for?

・Is your company negotiating for a partnership with a rival company? If so, what is the outline?

・By looking at the work history of the management team, you can determine to some extent the feasibility of the business plan.

・How much of a deficit is the company incurring? What is your cash balance? By when will we end up short-circuited if we don’t raise funds? In the unlikely event that you have to reduce your trading, when is the right time?

・Are rival companies or their group companies among the shareholders? etc.

What do you think? After knowing this information, wouldn’t it be better to co-create with a startup to find a better form? Of course, it is prohibited to steal only important information by flickering about investments. Naturally, a non-disclosure agreement will be effective, but more than that, it will spread bad publicity in the (narrow) startup investment community, and have a negative impact on other investment projects and co-creation projects.

To be continued